Investment Intelligencefor better decisions

Transform your investment process with AI-powered analysis, proprietary quantitative models, and institutional-grade research.

Powered by Quantitative Intelligence

Advanced AI models analyzing millions of data points across 40+ global markets

Multi-Factor Scores

Proprietary quantitative models evaluate 15+ factors for every security

AI-Powered Insights

Real-time analysis generating actionable investment recommendations

Portfolio Optimization

Holistic analysis revealing hidden risks and optimization opportunities

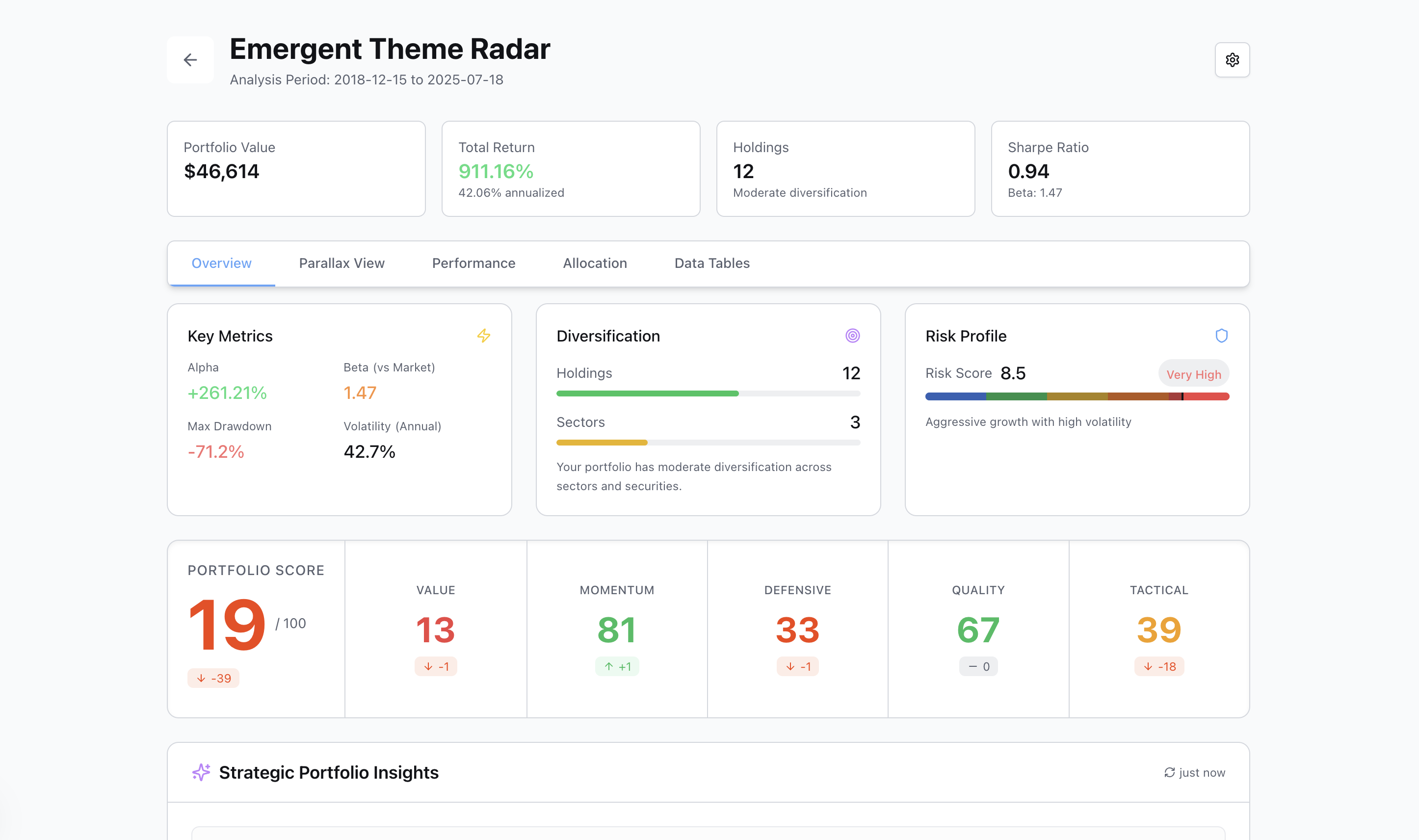

See our platform in action

Comprehensive analytics with multi-factor scoring and real-time risk assessment

Portfolio Intelligence Dashboard

Investment Research, Reimagined

From hours of manual analysis to instant portfolio intelligence

Multi-factor scores for every holding

Portfolio-level risk analysis

AI-generated optimization insights

Institutional-grade research reports

Complete analysis in seconds, not days

Stop spending weeks researching. Start making better decisions today.

Ready to transform your investment process?

Join professional investors using our AI-powered platform to make smarter, data-driven investment decisions.